Don’t see it? No problem, we’ll help you navigate which coverages are the best fit for you. Click or call to speak with an agent.

Insurance The Way It Should Be

Protecting your family, home and well-being is of crucial importance and at Ford Insurance, we take this task seriously. We understand the importance of finding the balance between protection and affordability. That’s why we work closely with you to develop a personalized insurance plan that provides the peace of mind you deserve at a price you can afford.

With over 100 years of experience, we have helped countless individuals protect what matters most to them.

Explore the most popular personal insurance options below.

HOMEOWNERS

Homeowners insurance provides protection for your home and your belongings such as furnishings, appliances and electronics. There are a variety of optional coverages and limits you may choose to protect what matters most to you. Most homeowners policies also include liability coverage, providing protection for certain accidents that may occur within your home or on your property.

AUTO INSURANCE

Also called car insurance – auto insurance provides protection for your vehicle if damaged and for damage or injuries you cause to others. There are a number of coverages available on auto policies and you may choose different limits and deductibles to fit your needs. If you bundle home and auto insurance you will also receive a discount!

PERSONAL UMBRELLA

Umbrella policies are essentially insurance above and beyond other liability policies that you may have. Without this type of coverage you would have to pay out of pocket for losses that exceed your other policies limits. For example, if you cause a car accident seriously injuring someone and their medical bills exceed the limits of your auto policy, an umbrella policy would kick in and provide additional coverage.

BOAT

Similar to auto policies, boat insurance provides protection from damage to your boat both from collisions and other causes along with liability insurance which helps pay for damages and injuries to others. Also like auto insurance you can receive discounts by bundling it with other home or auto policies.

LIFE INSURANCE

Life insurance helps provide peace of mind by planning for an unexpected future. Nobody wants to think about the worst case, but worse yet is thinking about what your loved ones must go through if it happens. Life insurance helps provide financial certainty to those you leave behind. There are many types and forms of life insurance polices designed to fit all manner of needs.

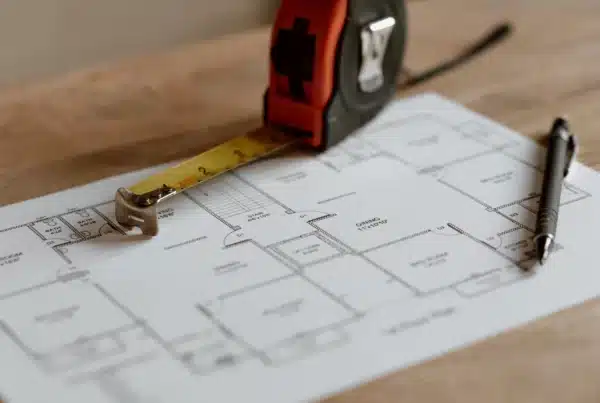

RESIDENTIAL BUILDERS RISK

Sometimes referred to as “course of construction” insurance, a Builders Risk policy covers your home while it’s being built including the materials, supplies, equipment and other costs associated with completing the project. Most lenders will require this coverage to be in place before providing a mortgage or construction loan.

PET INSURANCE

Pets are family too and they deserve the same love and care that we do. Pet insurance is an affordable way to ensure your furry friend has access to the medical care they may need. Many plans also offer preventive care services which can help save money on routine exams and vaccinations.

Interested in more content? Check out our Youtube channel

Interested in more content? Check out our Youtube channel